how much does the uk raise in taxes

A surcharge of 15 on investment income kept the overall top rate on that income at 90. Tax revenues as a percentage of GDP for the UK in comparison to the OECD and the EU 15.

Spring Statement Is This Really The Biggest Personal Tax Cut For 25 Years Bbc News

In 2022-23 we expect fuel duties to raise 262 billion.

. Fuel duties are levied on purchases of petrol diesel and a variety of other fuels. This was an increase of 04 compared to the previous year. The increased taxes will raise almost 36 billion 496 billion over the next three years according to the government with money from the levy going directly to Britains health-.

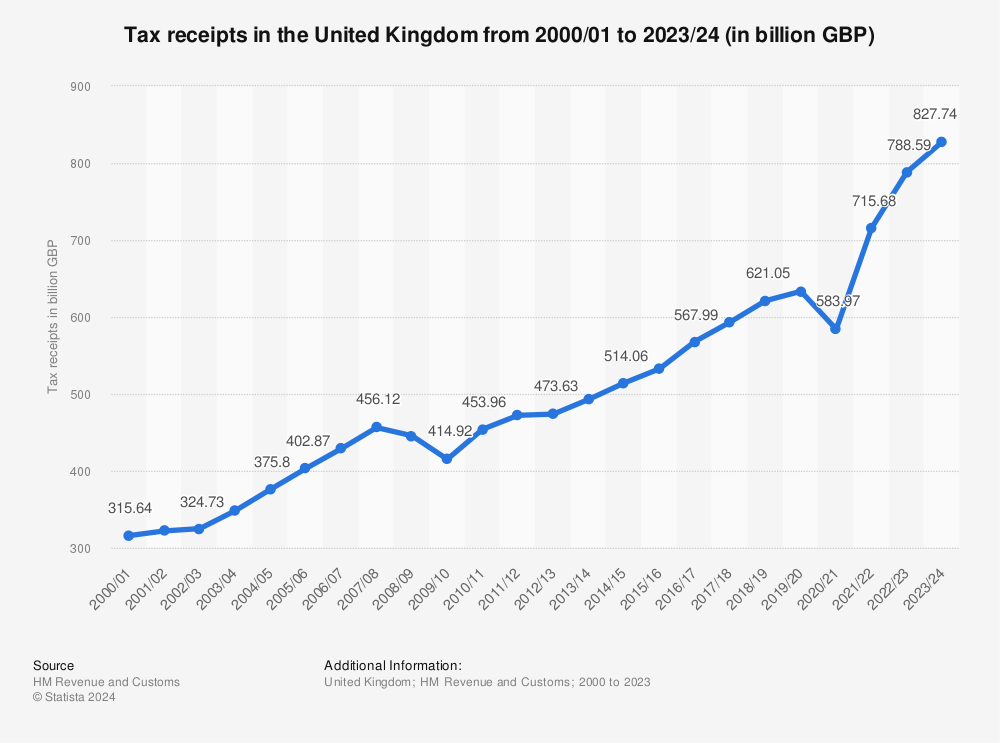

Tax receipts in the UK 2000-2022. UK Government Expenditure Statistics. Of the big three taxes.

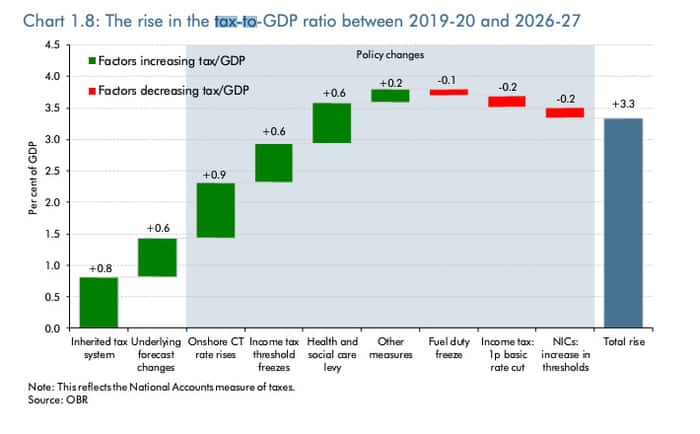

That would be an extra. An incoming government increase taxes in order to limit the scale of public spending cuts required to meet its fiscal targets. - -- a 1 percentage point rise in all rates of income tax would raise 55 billion.

How much does the uk raise in taxes Wednesday March 16 2022 Edit. This was true in 2010 and is forecast to be true in five years time. Government expenditure as a percentage of GDP in the United Kingdom was at 354 in 201920.

Thats a big difference - 10000 extra for the government. In 1974 the top tax rate on earned income was again raised to 83. - -- a 1 percentage point rise in all employee and self-employed National Insurance.

Employee earnings threshold for student loan plan 1. Marginal bands mean you only pay the specified tax rate on that. It will automatically calculate and deduct repayments from their pay.

The average rate for the higher earner would increase from 51 to 67 if the UK imported the Belgian tax system. Book a call today. The table below shows how much tax you are likely to pay in 2022-23 if youre a Scottish taxpayer.

This represents 247 per cent of all receipts and is equivalent to 7600 per household and 92 per cent of national income. The taxman is set to raise less from fuel duties. In 2021-22 we estimate that income tax will raise 2132 billion.

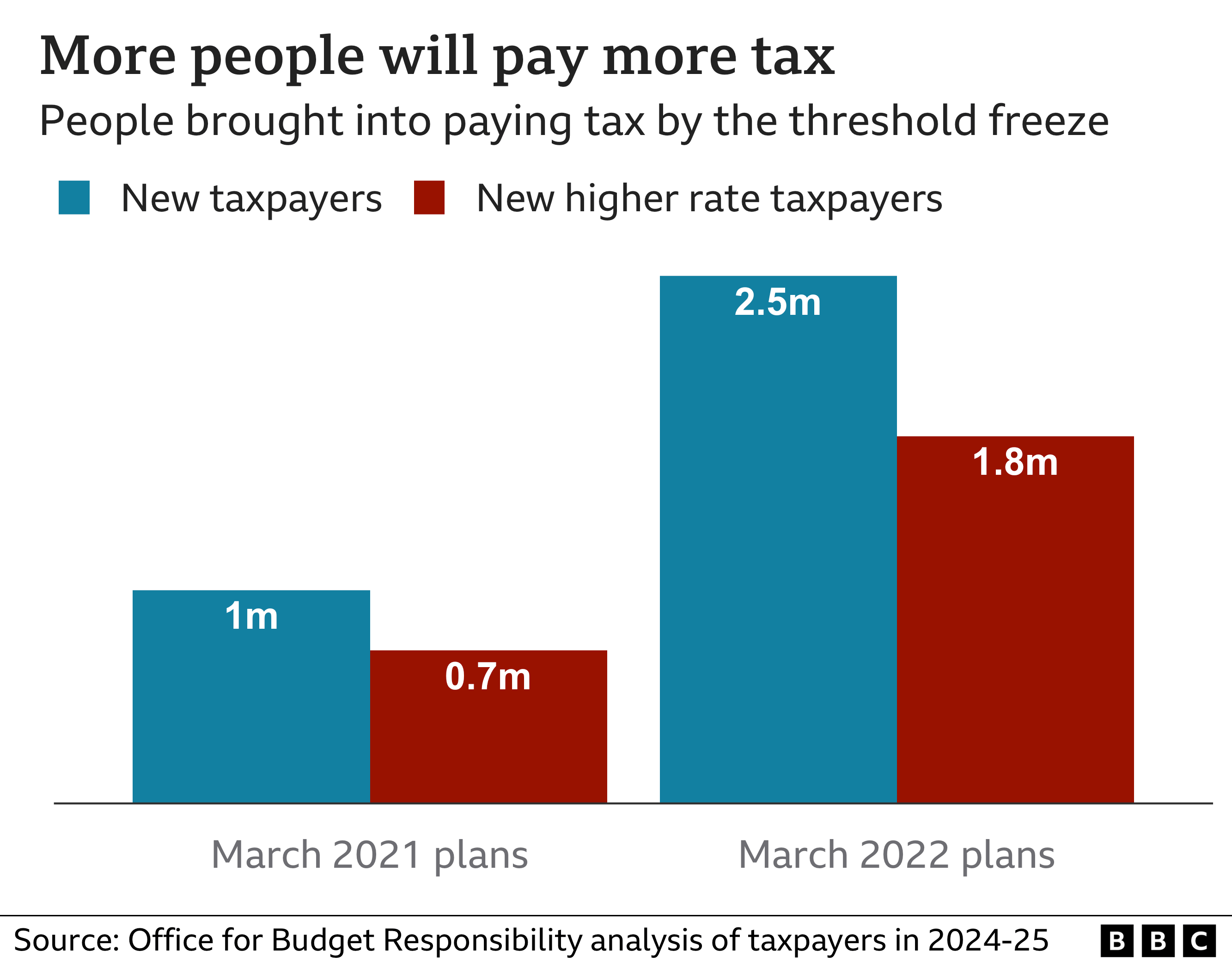

Johnsons office favours a 1 rise in the tax while the finance ministry is possibly looking at a higher rate of up to 125 the Telegraph. Pa Unemployment Base Year Chart Sales Taxes In The United States 350 275 Of Best Of Pa Unempl Tax Chart Sales Tax Can Countries Lower Taxes And Raise Revenues Laffer Curve Revenue Tax. Most taxpayers will see their tax bills increase from April 2022.

In 1971 the top rate of income tax on earned income was cut to 75. But this relative stability masks important changes in the composition of revenues. Ad Try the UKs fastest and most trusted digital tax advice service.

2022 to 2023 rate. How much does the UK government spend each year. Home does raise taxes uk.

At the University of Greenwich we estimate that such a tax on just the top 1 of wealthiest households in the UK could raise 70bn to 130bn a. Income tax is devolved in Scotland which is why there are different rates and thresholds to the other UK nations. They represent a significant source of revenue for government.

Personal tax advice whether youre a sole trader UK expat investor landlord and more. In 202122 the value of HMRC tax receipts for the United Kingdom amounted to approximately 71822 billion British pounds. Companies with profits between 50000 and 250000 will pay tax at the main rate reduced by a marginal relief providing a gradual increase in the effective Corporation Tax rate.

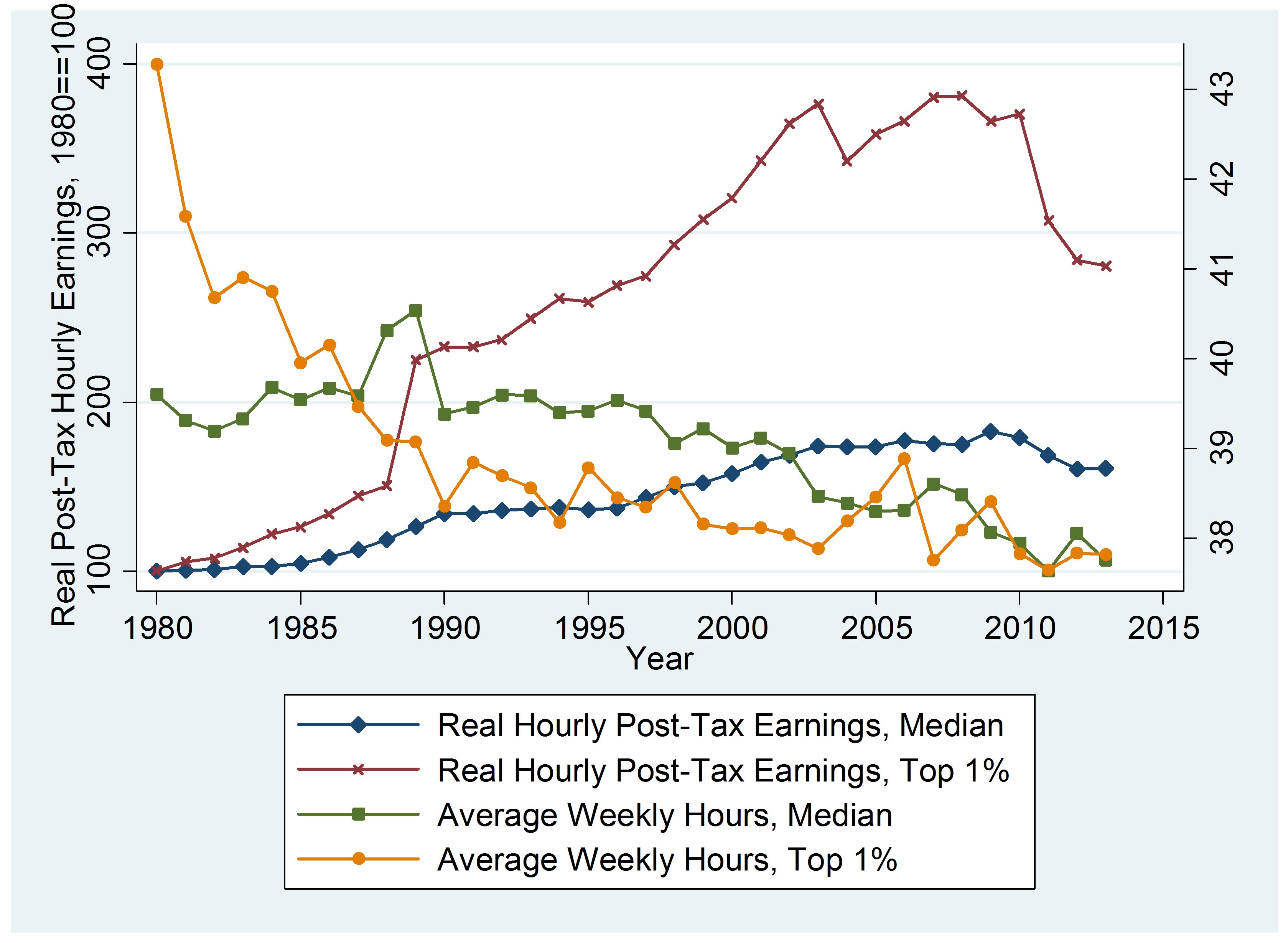

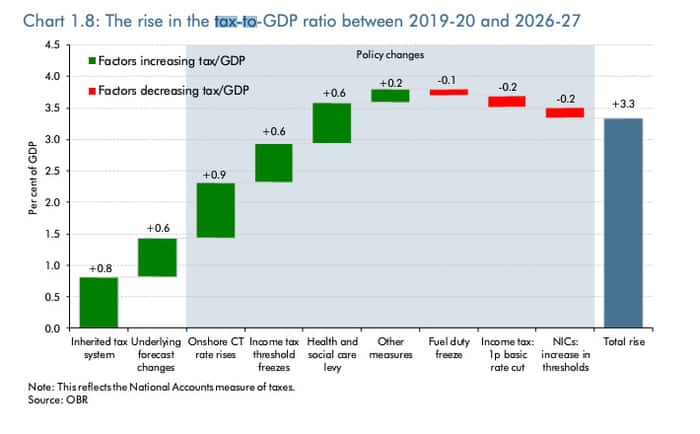

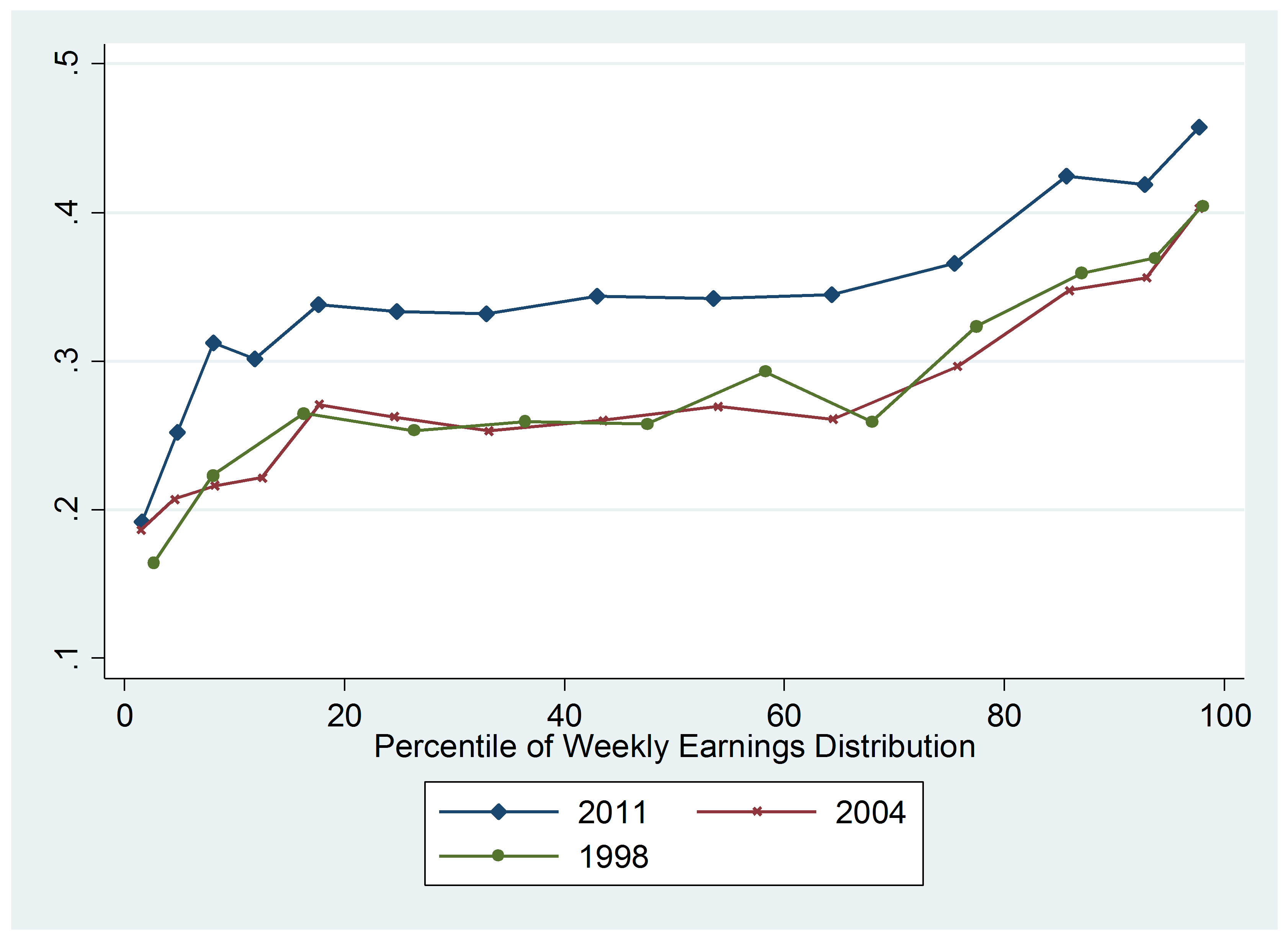

In 202122 receipts from capital gains tax in the United Kingdom amounted to approximately 149 billion British pounds an increase of approximately 37 billion pounds when compared with the. The main reason that income tax is the biggest source of revenue is that personal income makes up the majority of total national income. For example income tax is due to raise a lower share of total taxes and come more from the top 1 of income tax payers.

That would represent 27 per cent of all receipts and is equivalent to around 930 per household and 10 per cent of national income. 201920 was the first time since 201011 that spending as a percentage of GDP has increased. This represented a net increase of over.

For the 202223 tax year if you live in England Wales or Northern Ireland there are three marginal income tax bands the 20 basic rate the 40 higher rate and the 45 additional rate also remember your personal allowance starts to shrink once earnings hit 100000.

Tax On Test Do Britons Pay More Than Most Tax The Guardian

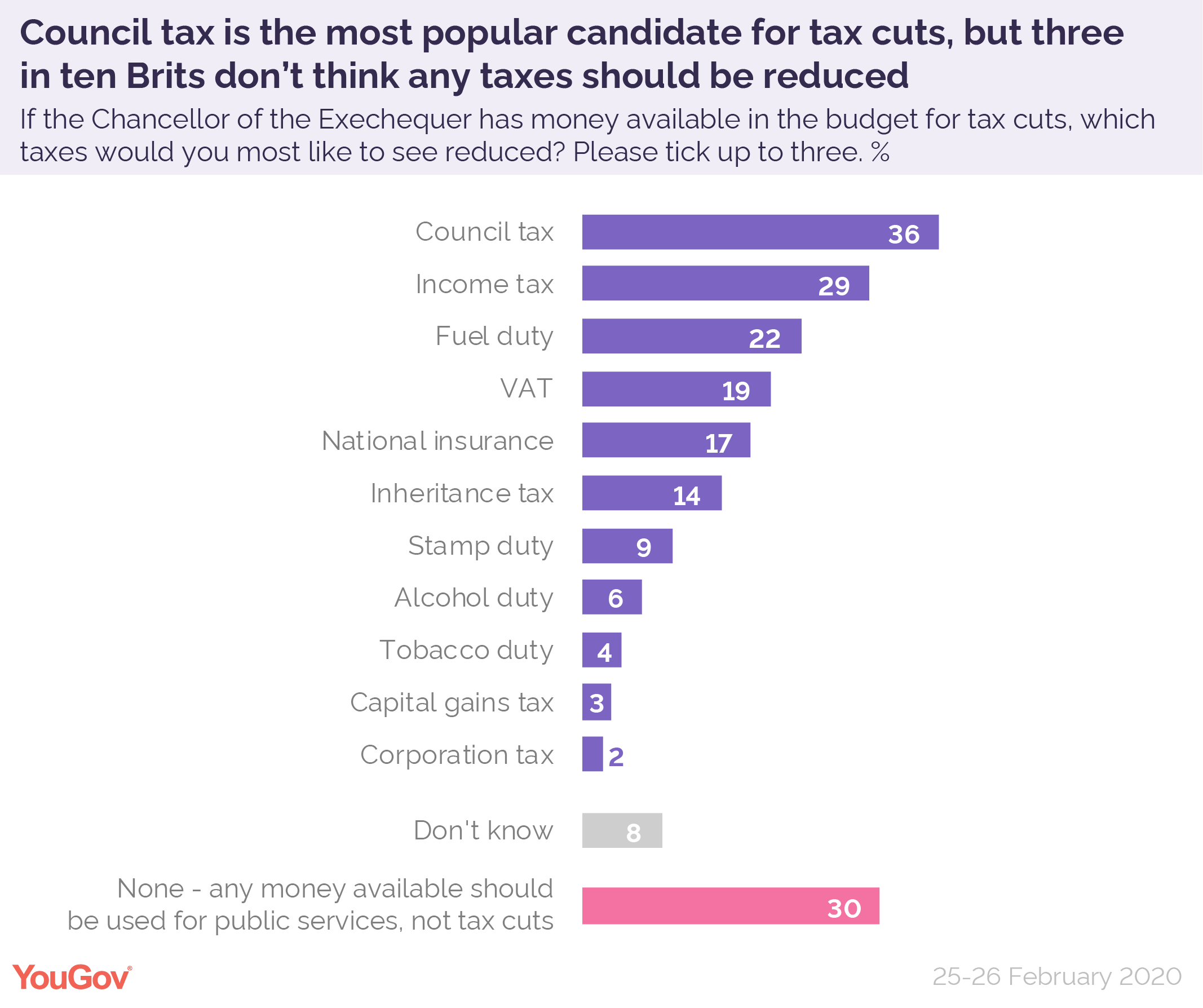

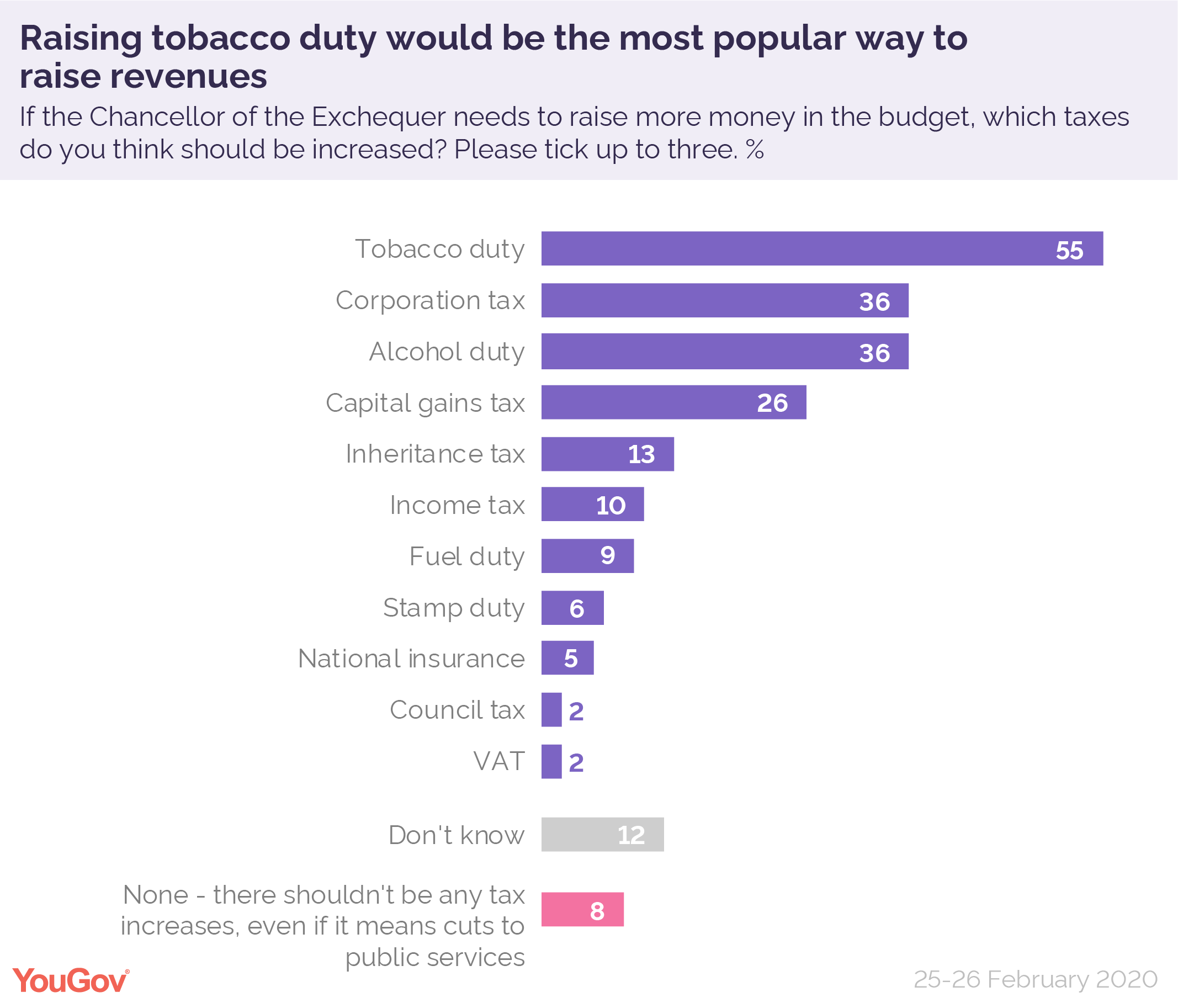

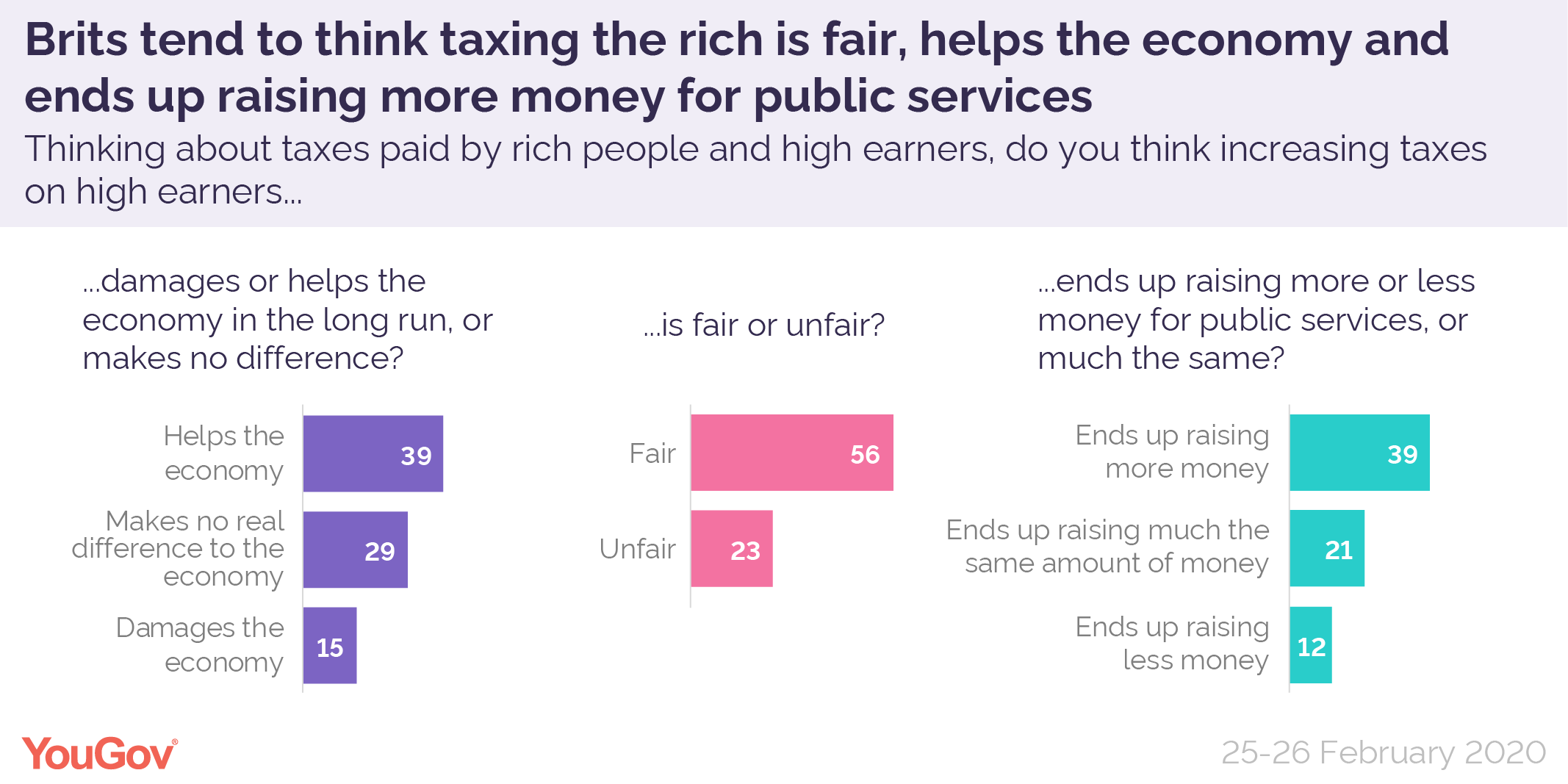

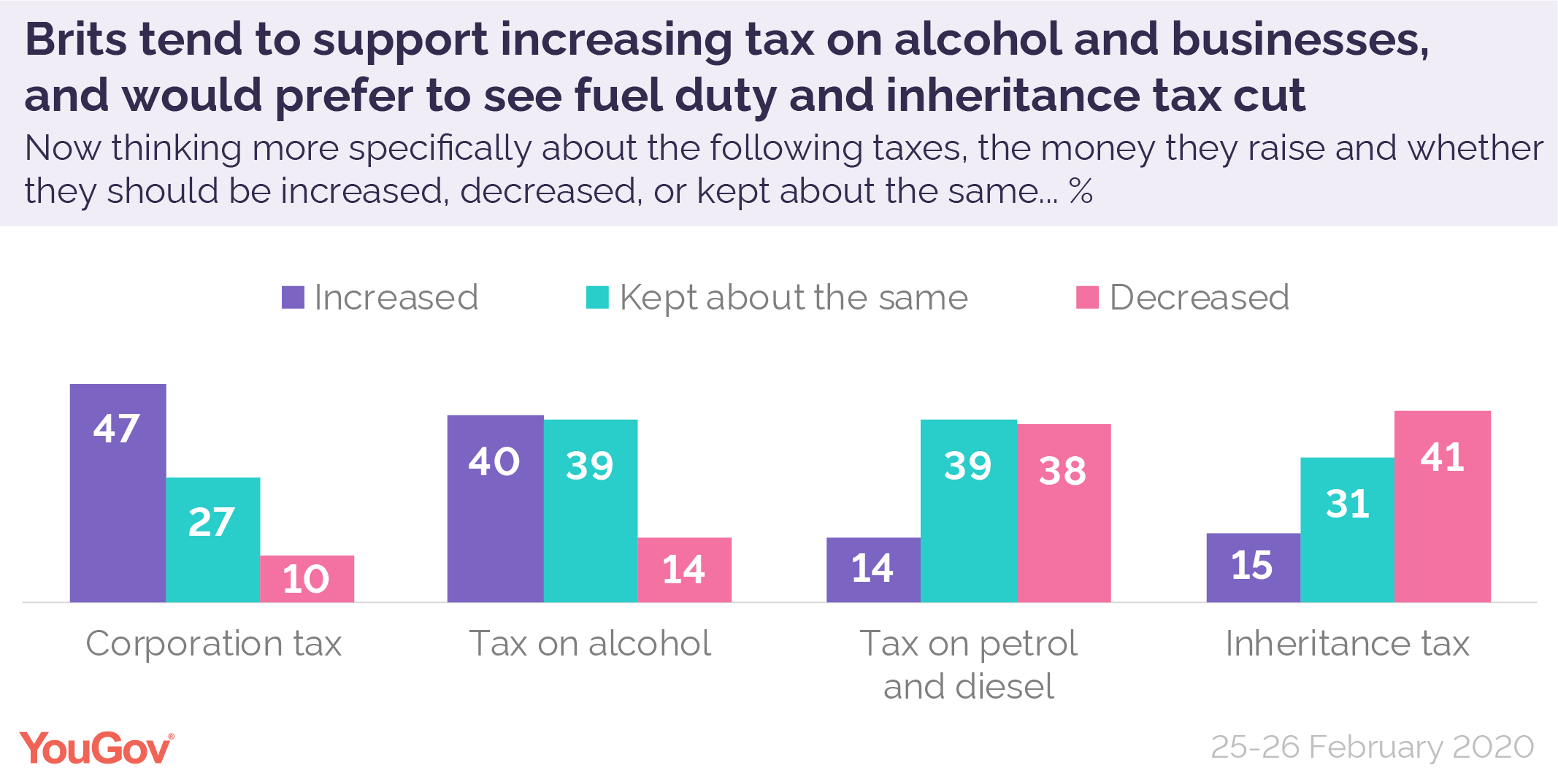

Budget 2020 What Tax Changes Would Be Popular Yougov

Uk Imposes 25 Energy Windfall Tax To Help Households As Bills Surge Reuters

Council Tax Increases 2021 22 House Of Commons Library

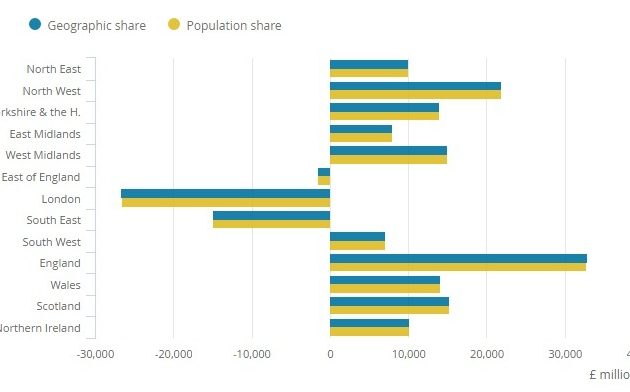

The Wealth Of Regions Measuring The Uk S Tax And Spending Imbalance National Statistical

The Top Rate Of Income Tax British Politics And Policy At Lse

Budget 2020 What Tax Changes Would Be Popular Yougov

Council Tax Increases 2021 22 House Of Commons Library

How Do Us Corporate Income Tax Rates And Revenues Compare With Other Countries Tax Policy Center

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

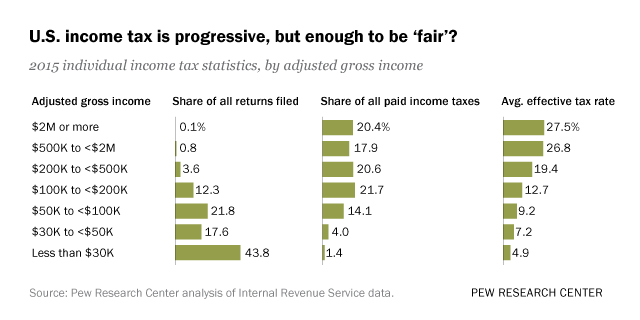

Who Pays U S Income Tax And How Much Pew Research Center

Spring Statement 2022 Living Standards Set For Historic Fall Says Obr After Sunak Mini Budget As It Happened Politics The Guardian

The Top Rate Of Income Tax British Politics And Policy At Lse

Budget 2020 What Tax Changes Would Be Popular Yougov

How Do Taxes Affect Income Inequality Tax Policy Center

Budget 2020 What Tax Changes Would Be Popular Yougov

Taxes And Health Care Funding How Does The Uk Compare The Health Foundation

The Top Rate Of Income Tax British Politics And Policy At Lse